Spotlight on Transfer Taxes: The High Cost of No Planning

By Jennifer Grammer, CPA, Whitley Penn and Cecily Bolding, CFP®, Northern Trust

With record-high estate tax exemptions set to expire at the end of 2025 barring action from Congress, more wealthy families are, understandably, focused on taking advantage of current exemption amounts to optimize their plans. While we broadly believe it is better to plan for all outcomes than attempt to predict the shape of future tax policy, we have prepared the following case study in an effort to simplify understanding of transfer taxes and shed light on a potential challenge that more Americans could face beginning in 2026. Note that in the example below, we use limits applicable to a married couple; the limits for individuals are halved.

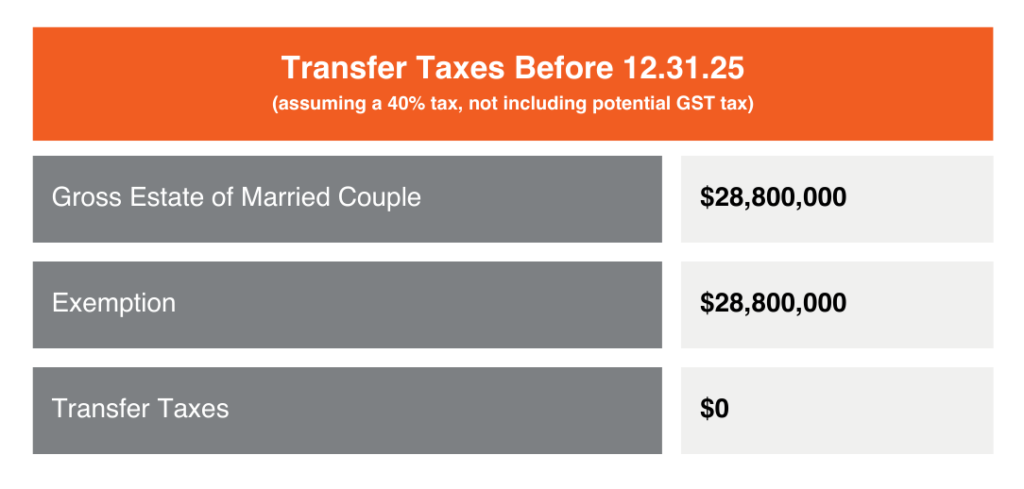

A married couple with a gross estate — defined as the total value of their liquid and illiquid assets at the time of their passing — of no more than $28,800,0001 (assuming they have made no taxable transfers during their lifetimes) would not be subject to transfer taxes should they both pass before Dec. 31, 2025.

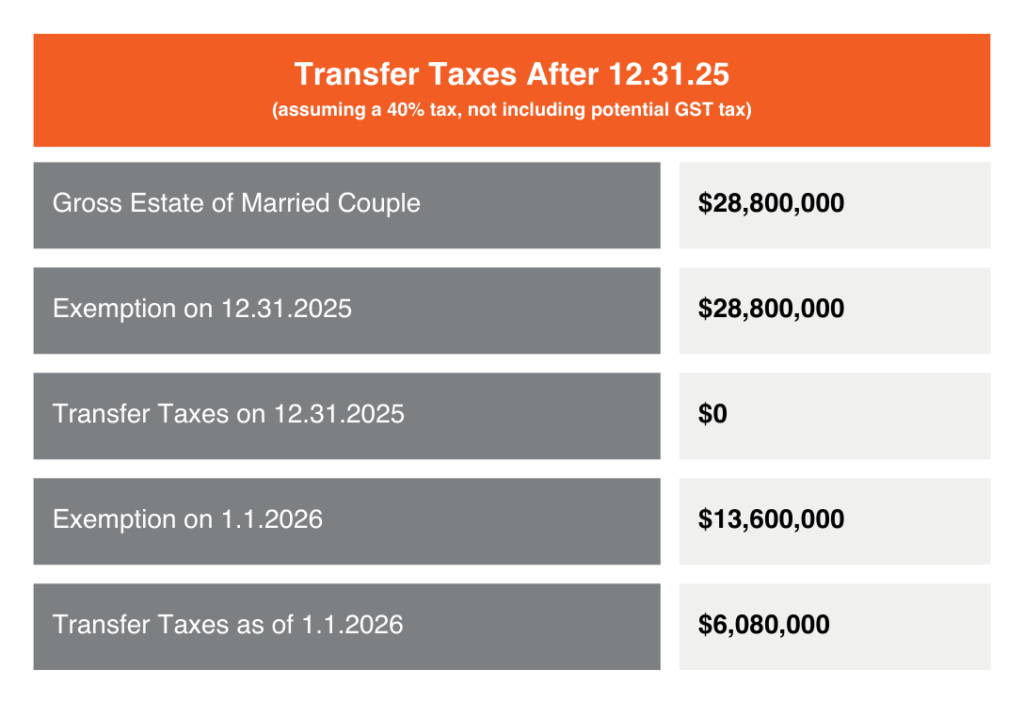

However: If the transfer tax exemptions sunset at the end of 2025 as currently anticipated, the couple would be facing a tax of $6,080,000 if they both survive until 2026 (see chart 2).

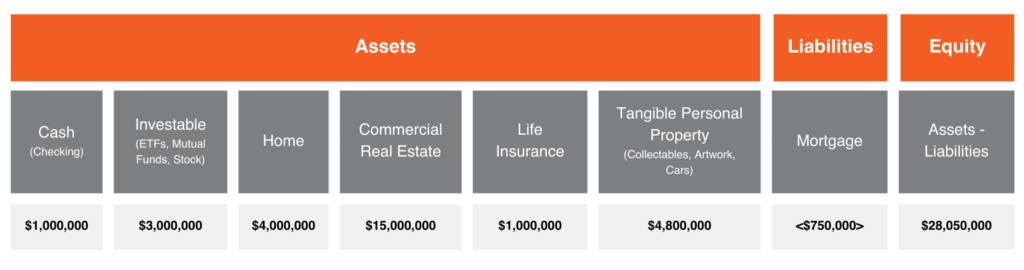

For the sake of illustration, consider the couple has the following balance sheet toward the end of 2025.

The couple understands that with their current balance sheet, their estate tax liability is $02. Assume, however, the couple passes away in early 2026 with an identical balance sheet.

In this example, the executor of the estate determines that 100% of the couple’s liquid assets will be needed to satisfy the estate tax of $6,080,000, leaving a balance of $1,080,000 — which will require illiquid assets to be sold. As we know, selling real estate during a recession, for example, would be suboptimal.

Had the hypothetical couple engaged in thorough financial planning ahead of their passing, the executor and their beneficiaries might have avoided this predicament. How could the couple have avoided this outcome, and what can we learn from it?

A married couple with a gross estate — defined as the total value of their liquid and illiquid assets at the time of their passing — of no more than $28,800,0001 (assuming they have made no taxable transfers during their lifetimes) would not be subject to transfer taxes should they both pass before Dec. 31, 2025.

However: If the transfer tax exemptions sunset at the end of 2025 as currently anticipated, the couple would be facing a tax of $6,080,000 if they both survive until 2026 (see chart 2).

For the sake of illustration, consider the couple has the following balance sheet toward the end of 2025.

The couple understands that with their current balance sheet, their estate tax liability is $02. Assume, however, the couple passes away in early 2026 with an identical balance sheet.

In this example, the executor of the estate determines that 100% of the couple’s liquid assets will be needed to satisfy the estate tax of $6,080,000, leaving a balance of $1,080,000 — which will require illiquid assets to be sold. As we know, selling real estate during a recession, for example, would be suboptimal.

Had the hypothetical couple engaged in thorough financial planning ahead of their passing, the executor and their beneficiaries might have avoided this predicament. How could the couple have avoided this outcome, and what can we learn from it?

Takeaways:

- If you have a balance sheet with assets totaling $10M or more, this change is worth a planning discussion with your Even if the exemption amount is greater than your asset total today, assuming a conservative growth rate, you could be affected by transfer taxes by the time your estate tax comes due.

- If you know you are holding an illiquid asset that has potential to significantly appreciate (e.g., real estate in a high-growth area), consider transferring this asset into a trust that is out of your estate.

Takeaways:

- If you have a balance sheet with assets totaling $10M or more, this change is worth a planning discussion with your professional advisor(s).

- Even if the exemption amount is greater than your asset total today, assuming a conservative growth rate, you could be affected by transfer taxes by the time your estate tax comes due.

- If you know you are holding an illiquid asset that has potential to significantly appreciate (e.g., real estate in a high-growth area), consider transferring this asset into a trust that is out of your estate.

Contact a Professional

References:

- This amount is an estimate of the amount that will be available in 2025. The exact amount of the exemption for 2025 has not yet been released. It will be based on an inflation adjustment to the 2024 amount of $13.61 million.

- This assumes they are residents of Texas and all of their real property is in Texas or another state that does not impose a state level estate tax.

**Indexed inflation amounts are estimated and subject to change. IRS issues inflation indexes each year.